· 6 min read

Solana Memecoin Weekly Update #3

Solana weekly meme coin update from June 05 - June 12.

The fed has held firm on interest rates, Andrew Tate has joined in on the meme coin mania, and Bitcoin is experiencing extreme volatility—all within the span of a single week.

The crypto space is as chaotic as ever, but at SolanaGeek, we’re here to make sense of it all for you.

Ready to get started? Grab a cup of coffee, and let’s dive into the macro updates! 👇

Part 1: Macro News

No Rate Cuts This Month

The biggest update this week is the Fed’s decision to maintain current interest rates. This is what we expected, but the market has reacted with extreme volatility. Bitcoin has been fluctuating between $67,000 and $70,000 over the past few hours in response to this decision. As illustrated in the graph below, Bitcoin has dumped 10% the day before each FOMC meeting, then proceeds to recover the entire move on FOMC day.

Inflation Eases Slightly

Some good news. U.S. inflation has shown signs of slowing down. The Consumer Price Index (CPI), rose by only 0.2% in May, from the previous month. Year-over-year, the core CPI increased by 3.4%, the slowest pace in over three years. This is good, and we need it to continue slowing down in hopes for future rate cuts.

Macro Conclusion

This week’s news is exactly what we expected. Historically, the summer is a slow period for crypto, and this year appears to be no different. That being said, I’m extremely bullish on Q4 for Bitcoin and alts. As inflation continues to slow, there’s a strong possibility of interest rate cuts, which would be the start of a big run towards the end of the year.

Part 2: Chart Updates

Understanding the Charts

Indicators by Trading Alpha

- Green/Red dots: Micro bullish/bearish trend

- Green/Red candles: Macro bullish/bearish trend

- Green/Red arrows: Signals strong bullish/bearish momentum.

- Top Candles: Orange candles labeled with a T. Signal a potential local top.

- Bottom Candles: Blue candles labeled with a B. Signal a potential local bottom.

- Reversal Candles: Bullish reversal = Turquoise, Bearish reversal = Yellow

BTC/USD: Daily

It’s been quite a hectic week for bitcoin. We saw a lot of bearish pressure from the FUD of the FOMC meeting. However as soon as we heard about the inflation numbers being lower than expected, we got a decent spike up. But when no interest rate cuts were announced, we started to retrace the bounce. Notice all the Top and Reversal signals we got at the white line resistance, as well as the shaded squeeze region nudging at a volatile movement incoming. These were clear indications to exercise caution and not jump into any large positions until a clear direction was determined.

By drawing a fib range from the swing low to swing high, we see the price action has reversed right off the 382 fib level. This is a very bullish level for the price action to reverse from. It’s important to note that the turquoise reversal candle is not confirmed unless one of the two following candles closes ABOVE its wick.

As stated above, the markets usually retrace the dump after the FOMC event. So we need to see what happens in the next few days.

If we can regain the bullish momentum, we should get another chance at cracking that stubborn 71.5k resistance.

In a bearish scenario, it would be best to watch for the lower fib levels.

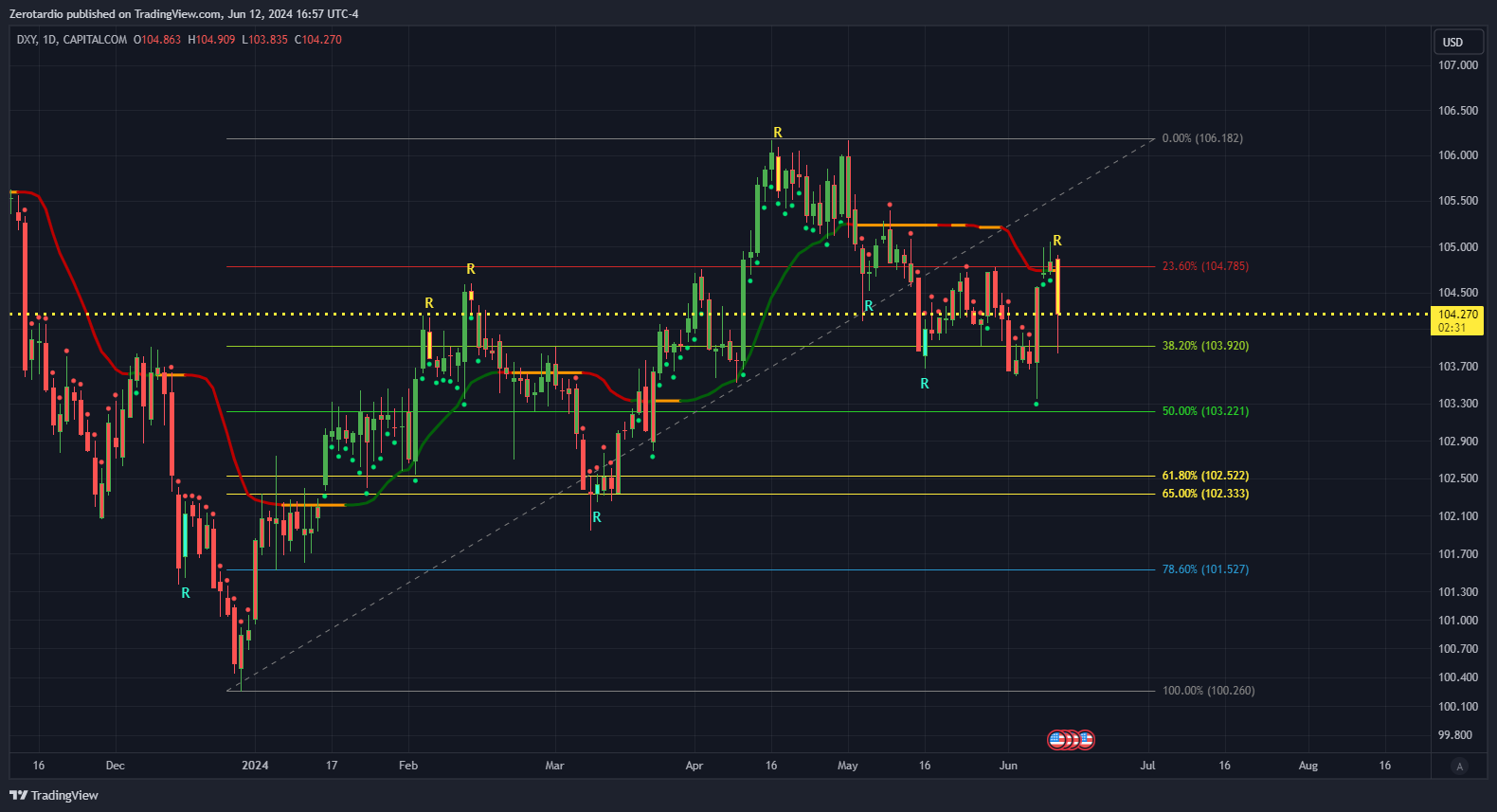

DXY: Daily

Analyzing the US Dollar index is crucial for predicting the crypto markets, because when the US dollar becomes weaker against other foreign assets, investors turn to Bitcoin as a stronger store of value. Therefore, when DXY goes down, BTC usually goes up, and vice versa.

In this chart, we can see that the past week was volatile for the dollar. Now, we are getting a massive bearish reversal candle, which in turn made BTC have a large spike upwards. You may also notice how well the dollar reacts to the trackline, making daily clean touches every time it approaches it. We just got a nasty rejection off the trackline. As long as the dollar continues to fall, we should be BTC and crypto markets pump. Keep an eye out for the fib levels as well.

SOL/USD: Daily

SOL has been having quite the downwards trend this week. We started printing red dots, falling under the trackline and printed a red macro trend candle. However because of the anticipation of the FOMC, we did get a volatile spike up and started to print a bullish reversal candle right on the golden fib ratio. This is also a very common and bullish level for price to reverse on. In order to determine the next steps for SOL, we really need to pay attention to BTC and how it will react post-FOMC event. Confirming this reversal candle will be very difficult because the wick is all the way at $161.

Overall Market Sentiment

Short term, things are quite unstable and more downside is likely. It’s important to watch how BTC reacts to the rejection of the rate cuts, as well as watching the DXY chart. Remember to analyze past crypto cycles and understand that summers are usually very slow for crypto. This is a great opportunity to slowly accumulate for the Fall season when we expect things to really take off!

Part 3: Meme coin ecosystem

The recent drop in Bitcoin’s value has taken a toll on meme coins, with the entire meme coin ecosystem down 9.8% over the past seven days. New launches this week have been poor, with none of them able to sustain any growth after launch. The “celeb meta” has been the biggest talk this week with Iggy Azalea and Andrew Tate’s meme coins going head to head.

Celebrity Coins

Andrew Tate recently endorsed the meme coin Daddy Tate, ticker $DADDY see tweet. This coin surged to a $269m Market Cap. He claims that if the coin hits $1 Billion market cap that he would burn his supply as long as it is worth at least $100 million.

In contrast, Iggy Azalea’s meme coin Mother Iggy, ticker $MOTHER, is at $182m Market Cap. Both of these coins are at extremely high market caps, which just goes to show the absurdity of the meme coin ecosystem.

I’ve never seen celebrity coins this high before, especially at this stage of the market cycle, so I have no idea what to expect. I’ll be closely monitoring both coins to see how they develop.

Meme coins to watch

With Bitcoin’s volatility this week, we won’t be bidding any new meme coins right now. We want to wait for Bitcoin to find a bottom before opening trades on meme coins.

If you want to see last week’s meme coin picks, check out Solana Geek Weekly Update #2

Be sure to follow us on X for our up-to-date takes on the market

Disclaimer

The information provided on this blog is for educational and informational purposes only and should not be construed as financial or investment advice. We are not licensed financial advisors, and the content on this blog is not intended to be a substitute for professional financial advice.