· 7 min read

Solana Memecoin Weekly Update #2

Solana weekly meme coin update from May 29 - June 05.

Roaring Kitty’s $180m GME position, celebrities launching memecoins, and bullish statements from VanEck’s ceo—should we be bullish or bearish on crypto right now?

There’s a lot going on in crypto right now, so I’m going to break down this week in crypto into an easily digestible blog post. Welcome to SolanaGeek, a crypto blog aiming to help degens make informed decisions in crypto.

Ready to get started? Grab a cup of coffee, and let’s dive into the macro updates! 👇

Part 1: Macro Updates

Since the approval of Ethereum’s ETF, we’ve had a rather slow week in crypto. Bitcoin has been flirting with it’s previous ATH, and Ethereum has stayed above $3700. These are great signs, but we need to break through old highs with volume for it to mean anything. We hope to see more development on the Ethereum ETF soon. Once trading goes live, we should start to see more inflows into $ETH.

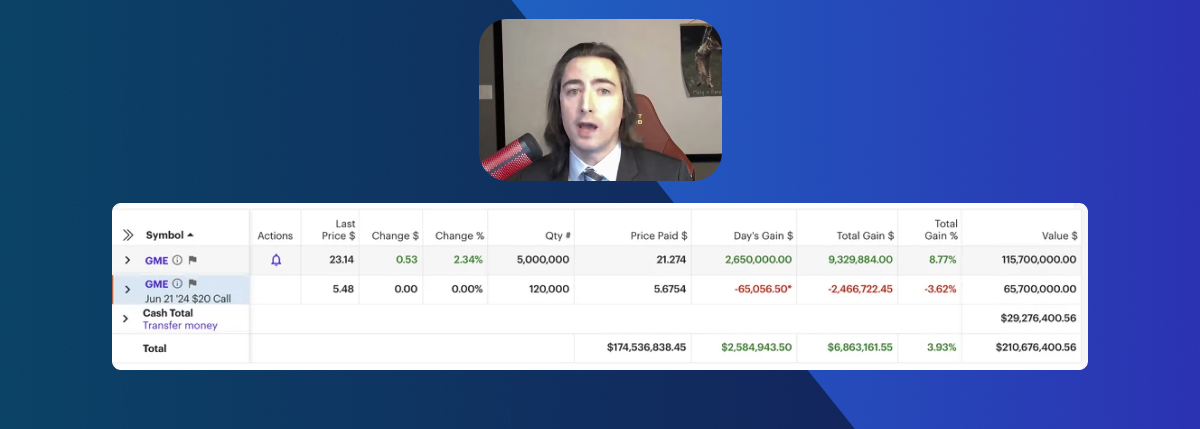

Roaring Kitty Is Back

On June 2nd, Roaring Kitty (a.k.a u/deepfuckingvalue) posted an update on his GME position in r/superstonk, showing that he holds over $180,000,000 in GME calls. Following this, the GME crypto coin, a memecoin on Solana, pumped 300% in one day (source).

What does this have to do with crypto?

In 2021, we saw a strong correlation between meme stocks and crypto. If history repeats, we might see similar trends this year, making it important to watch these movements closely.

In short, meme stocks pumping is very good for crypto.

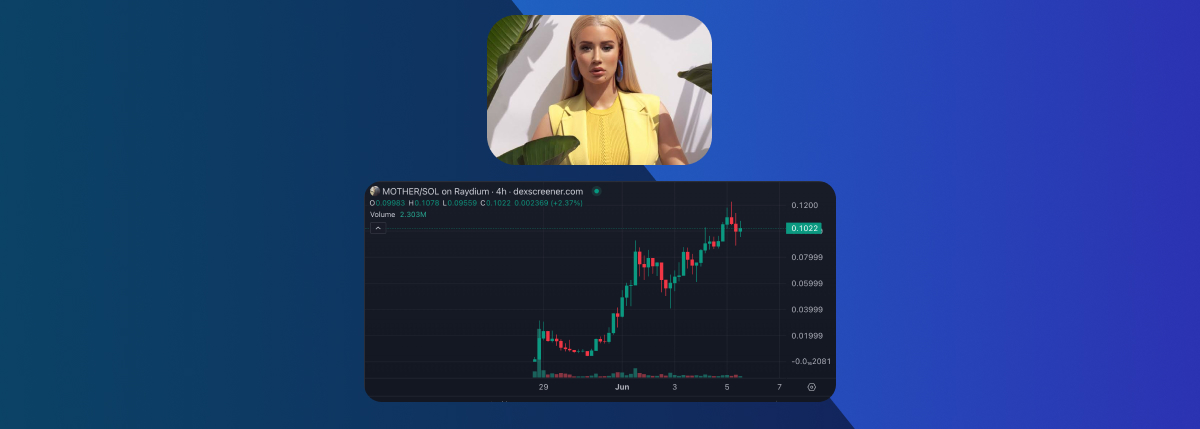

Celebrities Launching Meme Coins?!

One interesting addition, for better or worse, has been celebrities launching their own meme coins on Solana. Using pump.fun, celebrities including Iggy Azalea, Davido, and Caitlyn Jenner, have been able to launch their own meme coins. This is usually never a good thing in crypto, because celebrities typically drain liquidity and dump their tokens for personal gain, which we’ve already seen happen in these projects.

That being said Iggy Azalea, seems somewhat dedicated to her project, and her coin $mother is currently sitting at $90m market cap(source).

Job Openings Dropping

The latest job openings for April fell to 8.059 million from March’s 8.5 million, below the median forecast of 8.4 million. The market has reacted positively to the news of job openings dropping, as traders speculate that this could cause rate cuts to come sooner.

Bank Of Canada Cuts Interest Rates

Lastly, the Bank of Canada cut its benchmark interest rate by 25 basis points today, the first reduction in more than four years. This is great news, and we can hope to see more rate cuts around the world in the coming months. I expect the market to react positively to this news.

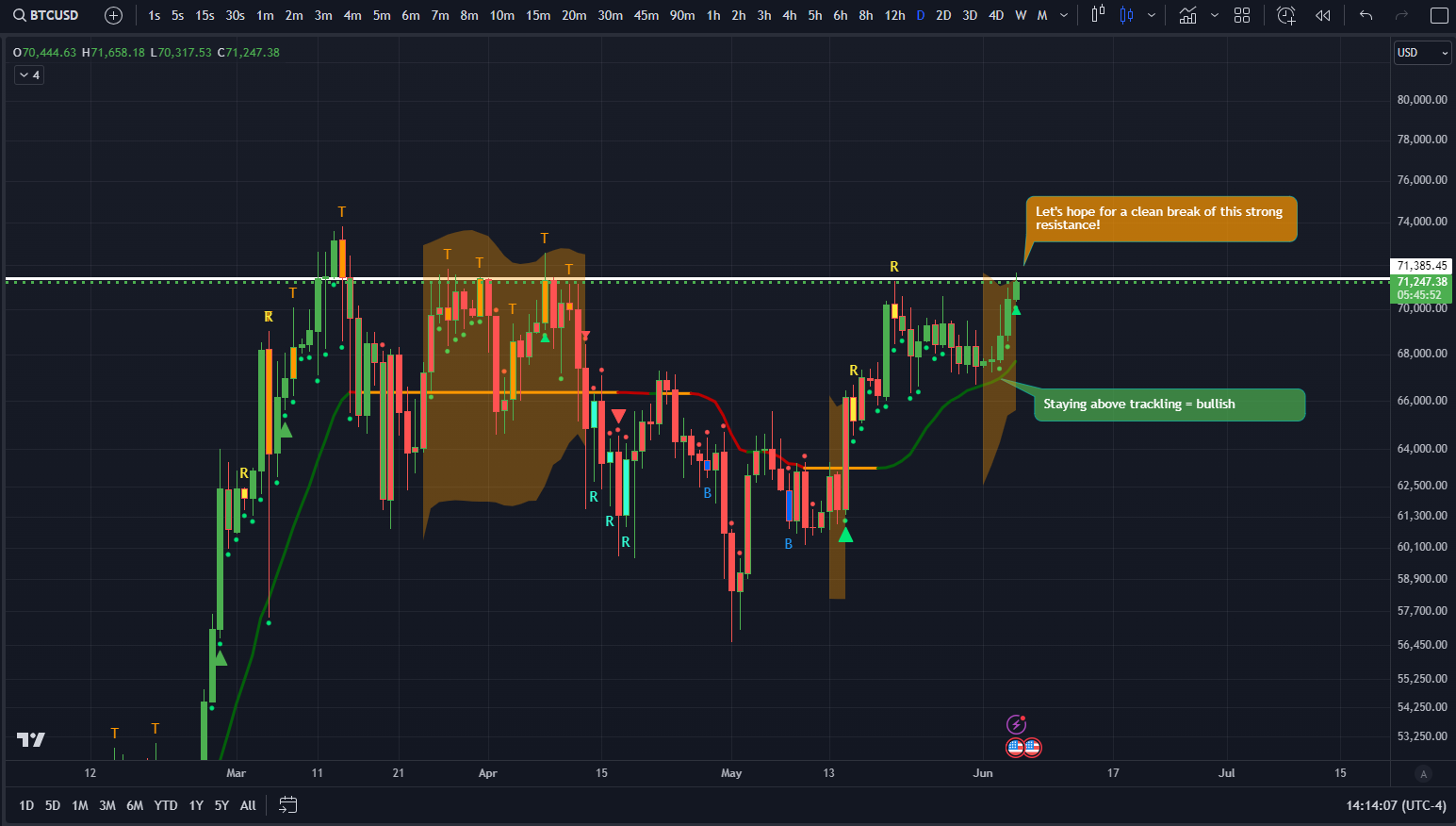

Part 2: Chart Updates

Understanding the Charts

Indicators by Trading Alpha

- Green/Red dots: Micro bullish/bearish trend

- Green/Red candles: Macro bullish/bearish trend

- Green/Red arrows: Signals strong bullish/bearish momentum.

- Top Candles: Orange candles labeled with a T. Signal a potential local top.

- Bottom Candles: Blue candles labeled with a B. Signal a potential local bottom.

- Reversal Candles: Bullish reversal = Turquoise, Bearish reversal = Yellow

BTC/USD: Daily

Although a slow beginning of the past week, we are ending it with high hopes! All our macro indicators are looking very bullish. We have green candles, green dots, a green trackline that was perfectly retested, and a big bullish arrow. After a nice consolidation period of 12 days, Bitcoin is coiling up for its next run up to the white resistance line. If we close above it, the next point of resistance is the ATH. If we break the ATH, we are in a full bull run!

Notice this approach to the white resistance line is different from the previous ones. We see a nice green candle with no Top or Reversal signals. This means that the likelihood of it breaking is much higher than the previous attempts.

ETH/USD: Daily

ETH has been holding up very well since the highly anticipated news of the ETF approval. However, our momentum indicators are starting to look weak. The MACD is right at the neutral point and can cross over to red very easily, and the moving averages are about to cross over and are highly over extended. RSI is also looking daily overextended with a bearish divergence.

Despite these indications, however, we could very well be consolidating right before another large surge upwards. This is usually the case after a strong bullish move. But it is recommended to not enter any positions until a clear direction is determined.

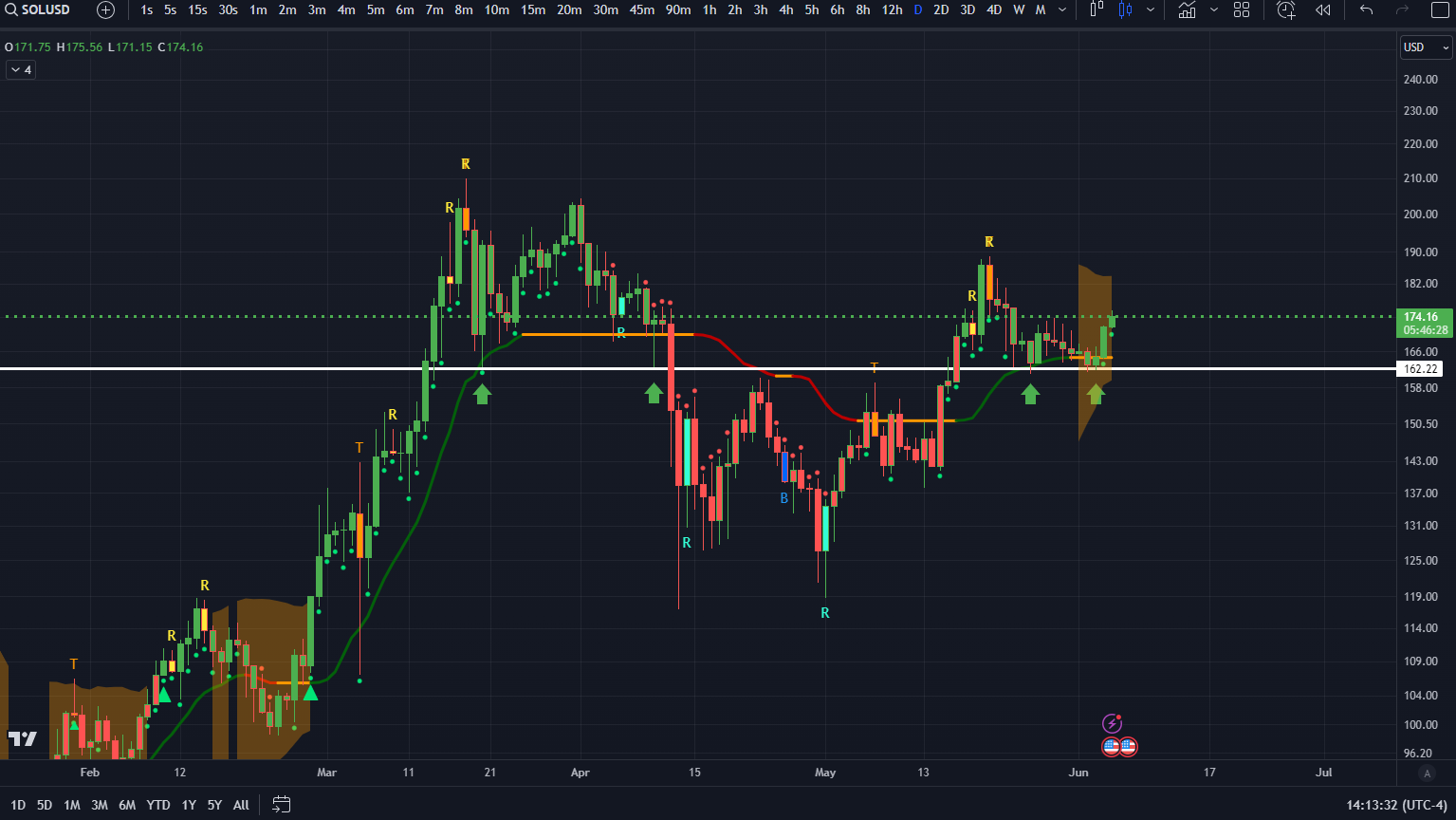

SOL/USD: Daily

After some boring downwards movement for the past 13 days, SOL looks like it’s making its next leg up. It retested the white support line perfectly. We continue to have our green candles and green dots, which is bullish in the macro and micro timeframes. If we can make a higher local high, we can expect to see SOL in the $190-$200 range.

Overall Market Sentiment

Although a slow week, we are still bullish long term! Remember to analyze past crypto cycles and understand that summers are usually very slow for crypto. This is a great opportunity to slowly accumulate for the Fall season when we expect things to really take off!

With some more great news that came our way, we remain bullish for the upcoming future. Our big caps are starting to make their next leg up after a nice healthy consolidation period.

Part 3: Meme coin ecosystem

It’s been a relatively flat week for meme coins as a whole, with a select few pumping. The entire meme coin ecosystem is down 2.4% in the last 7 days, which is to be expected from last week’s pump. I don’t expect much to happen for meme coins until Bitcoin can break through its previous ATH with volume.

As for meme coins I’m currently watching, I’m going to continue with last week’s picks since I still believe they’re the strongest meme coins on Solana. I’ve updated the charts below to how they’re performing this week.

Meme coins to watch

#1: Jeo Boden $boden ($212m Market Cap)

Boden, a meme coin parodying president Joe Biden, was consolidating for quiet some time, but we’re starting to see some movement again. It’s still far off it’s all-time high of $700 million market cap.

Boden has been making a descending triangle pattern for almost 60 days. Today (June 5 2024) we had a spike breaking out of this pattern. Unfortunately it does not look like it will close above, but having this spike is still bullish. We are at the apex of the pattern so a breakout must happen very soon. If no breakout occurs, then the triangle pattern will be invalidated.

#2: Dogwifhat $wif (3.4b Market Cap)

In our last update, we talked about WIF breaking out of a symmetrical triangle pattern, Now, we had a bullish descending wedge pattern which has also been broken. On the micro timeframe, we are looking bullish, We just need to get our green candles (macro indicator) for this coin to really take off.

#3: American Coin $USA ($55.4m Market Cap)

Our descending sloped resistance is playing out! After an initial fake-out which shook out the weak hands, it managed to close above the horizontal support and sloped line. We are now seeing a nice move upwards. It wouldn’t be a bad idea to get into an initial position and load up more on any dips if they come.

#4: Retardio ($18.7m Market Cap)

Not much has changed from last week’s update as we continue to consolidate at the bottom of the triangle. Since Retardio has become a native term in the crypto space lately, we expect this coin to run when the meme coin market really picks up. This coin is basically a sleeping giant.

#5: NUB (55m Market Cap)

Still chugging along nicely, NUB is a coin you definitely want to keep your eye on. It seems like the bottom has been determined at the horizontal blue line and we are on our way to slowly make higher highs.

Conclusion

Thank you for joining us again this week for our weekly market updates! Overall, we’re still very bullish on both crypto and meme coins these next few months.

We’re excited to continue sharing our insights and analysis with you. Stay tuned for next week’s post!

Feel free to follow our Twitters: Ben & Bijan. If you found this blog useful, send us a DM! :)

Disclaimer

The information provided on this blog is for educational and informational purposes only and should not be construed as financial or investment advice. We are not licensed financial advisors, and the content on this blog is not intended to be a substitute for professional financial advice.